Estimating a person's financial standing can provide insight into their economic position and influence within a given field. A precise figure for this individual's wealth remains elusive, hindering a full understanding of their economic contributions.

A person's net worth represents the total value of their assets, such as real estate, investments, and personal belongings, minus any outstanding debts. This calculation is not a static figure, as changes in asset values and liabilities can influence it over time. Publicly available information on a person's financial standing is often incomplete or outdated.

While precise net worth figures can be challenging to ascertain, the concept holds significance in various contexts. Understanding economic standing can offer insights into individual success, career trajectory, and financial acumen. However, without specific data, it is difficult to assess the broader implications of this person's economic standing for their profession or field.

| Category | Detail |

|---|---|

| Name | (Insert Name here) |

| Occupation | (Insert Occupation here) |

| Known for | (Insert relevant accomplishments/achievements) |

Further investigation into the individual's career, industry, and financial activities may provide additional context to better understand the economic landscape within the field. Information regarding income sources, investment practices, and philanthropy would be instrumental.

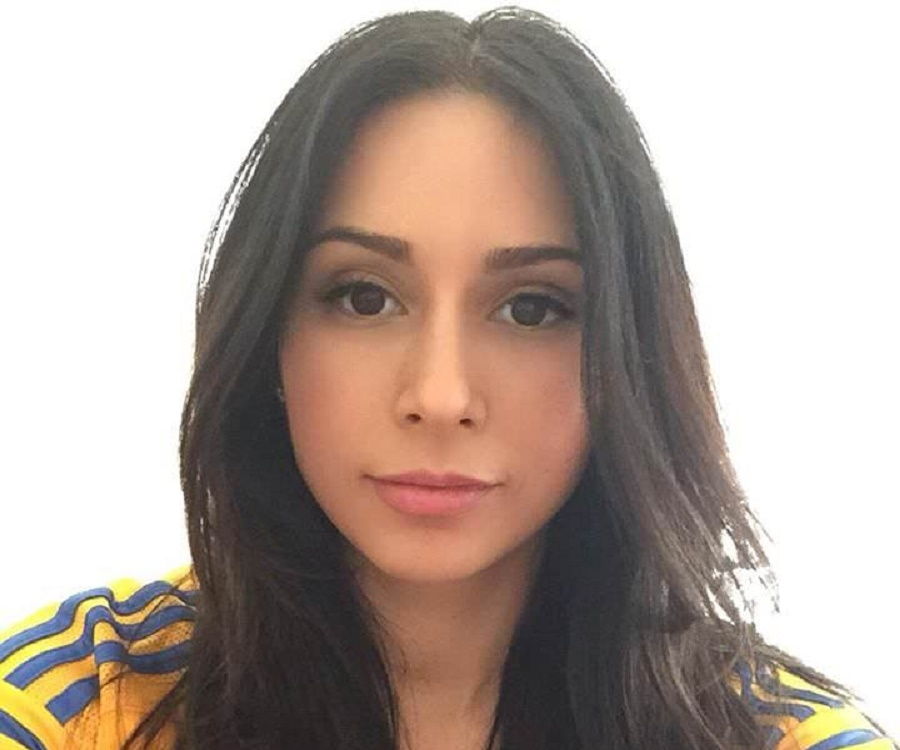

Patricia Azarcoya Schneider Net Worth

Assessing an individual's financial standing requires careful consideration of various contributing factors. This analysis explores crucial aspects related to financial valuation.

- Assets

- Income sources

- Investment history

- Liabilities

- Professional success

- Industry trends

- Public information

Understanding Patricia Azarcoya Schneider's net worth involves examining her assets, such as real estate and investments. Income sources, including salary and potential business ventures, play a role. Investment history demonstrates financial decisions and their impact. Liabilities like loans or debts must be factored in. Her professional accomplishments and industry influence contribute to the perception of financial success. Trends in the industry she's associated with can affect earning potential. Publicly available information often provides a limited but necessary starting point for estimations, while deeper analysis requires access to more complete financial data.

1. Assets

Assets represent valuable resources owned by an individual. In the context of determining Patricia Azarcoya Schneider's net worth, understanding the nature and value of these assets is crucial. Quantifying these resources is essential for calculating overall financial standing.

- Real Estate Holdings

Real estate, including properties like homes, land, and commercial buildings, represents a significant component of net worth. The value of these holdings depends on factors such as location, size, condition, and market trends. Fluctuations in real estate values can dramatically impact a person's overall financial position. For instance, appreciating property values contribute positively, while depreciating values can have a detrimental impact. Property location and type directly influence the perceived value.

- Investment Portfolios

Investments, encompassing stocks, bonds, mutual funds, and other financial instruments, are frequently a significant portion of net worth. The value of investments is dynamic, subject to market fluctuations and the performance of underlying assets. The diversification and risk tolerance of the portfolio play crucial roles. Investment returns and losses directly affect the final net worth calculation. Successful investment strategies and market conditions are pivotal elements in appreciating investment value.

- Personal Possessions

Personal possessions, encompassing valuable items such as art, jewelry, and collectibles, can contribute to a person's overall net worth. The value of these items is often dependent on factors like rarity, condition, market demand, and provenance. These possessions can be significant components if they are especially valuable or rare. Determining precise value might require expert appraisal.

- Liquid Assets

Cash and cash equivalents, including bank accounts, readily available investment funds, and other easily convertible assets, form the liquid portion of the portfolio. This category is crucial for immediate needs, financial flexibility, and responsiveness to market changes. This component of net worth is often readily accessible. Its presence and amount are essential indicators of financial health and liquidity.

These diverse asset categories, with their unique characteristics and valuation complexities, contribute significantly to the overall calculation of Patricia Azarcoya Schneider's net worth. Analyzing each component and understanding the potential implications for her financial position are pivotal in the evaluation process. Accurate evaluation requires careful consideration of all associated factors.

2. Income Sources

Income sources are fundamental to understanding an individual's net worth. The nature and scale of income directly influence the accumulation and maintenance of financial assets. Determining the various income streams of Patricia Azarcoya Schneider is essential for a comprehensive analysis of her overall financial position.

- Employment Income

Earnings from employment, whether salary or wages, form a crucial component of total income. The amount and stability of employment income heavily influence financial capacity. Professional field, seniority, and market conditions directly impact this income stream. Variations in employment income can reflect changes in career trajectory or market fluctuations. Consistent employment income typically contributes to a more stable financial profile.

- Investment Income

Earnings derived from investments, such as dividends, interest, or capital gains, represent an additional income stream. The success of investment strategies and market conditions profoundly impact these earnings. A robust investment portfolio can generate passive income, adding to overall financial security. Investment income can vary significantly based on investment choices and market performance.

- Business Income (if applicable)

Revenue generated from a business venture is a significant income source. The profitability of the business, market demand, and operational efficiency directly affect the amount of business income. Entrepreneurial activities can result in substantial earnings but often carry higher risk. Business income provides insight into business acumen and the overall financial health of an enterprise.

- Other Income Streams (if applicable)

Additional income sources may include royalties, rental income, or other forms of passive income. These sources contribute to the total income, affecting the overall financial position. The significance of these additional streams is contingent on the magnitude of these revenues relative to other sources. The presence and reliability of these supplemental sources offer a more thorough understanding of financial diversification.

Understanding the specific composition of Patricia Azarcoya Schneider's income sources provides valuable context for evaluating her overall financial standing. A thorough analysis of each income stream and their respective contributions to her net worth provides a comprehensive picture of her economic position and stability.

3. Investment History

Investment history plays a critical role in determining an individual's net worth. The decisions made regarding investments, encompassing the types of assets chosen, the timing of transactions, and overall strategy, directly impact the accumulated wealth. A detailed examination of investment history reveals patterns and trends that indicate financial acumen and risk tolerance. This understanding is essential for evaluating the sustainability and potential growth of an individual's overall financial standing. Consistent profitable investments tend to correlate with a higher net worth, while poorly managed investments often lead to decreased wealth.

Examining specific investment activities provides further insight. For instance, a history of successful equity investments can signal shrewd market timing and a capacity for generating significant capital appreciation. Conversely, consistently poor returns from speculative ventures may indicate a higher degree of financial risk-taking, possibly negatively impacting net worth. An understanding of the individual's investment choices reveals insight into their financial approach and risk tolerance, offering a more nuanced perspective of their financial standing. The successful management of investments over time often leads to greater asset accumulation and thus higher net worth, while poor investment strategies may result in diminished returns and a lower overall net worth. Analyzing specific examples of portfolio construction and rebalancing provides practical insight.

Understanding the connection between investment history and net worth is vital for a complete financial assessment. Investment decisions, both large and small, contribute to the overall financial trajectory. Assessing risk tolerance, investment goals, and the consistent application of sound financial principles offers insight into the factors influencing net worth. The complexity and volatility of financial markets underscore the importance of careful investment choices and the need for comprehensive analysis. An understanding of these factors enhances the accuracy of net worth estimations and contributes to a more profound understanding of financial health.

4. Liabilities

Liabilities represent debts or obligations owed by an individual. Understanding liabilities is crucial when evaluating an individual's net worth, as they directly reduce the overall financial standing. Debts, whether in the form of loans, mortgages, or outstanding bills, subtract from the value of assets. Therefore, a precise accounting of liabilities is essential for a comprehensive financial assessment. Accurate calculations are vital for determining the true financial position and understanding the potential financial burden for Patricia Azarcoya Schneider.

- Loans and Mortgages

Loans, encompassing mortgages for real estate, personal loans, and auto loans, constitute a substantial portion of liabilities. The outstanding principal balance of these loans directly impacts the net worth calculation. The interest payments on these loans also contribute to the total financial burden, reducing the available disposable income and net worth, depending on the monthly payment amounts. The length and interest rate of the loans are crucial considerations. Specific details about loan terms, interest rates, and outstanding principal are needed.

- Credit Card Debt

Credit card balances represent another significant liability category. High credit card balances can substantially reduce the available assets and potentially impact creditworthiness. The monthly interest charges add to the overall financial obligation. High-interest rates and unpaid balances can create significant debt burden and financial stress, which directly impact net worth. The repayment schedule and interest rates for these debts are essential factors.

- Taxes and Other Obligations

Outstanding tax liabilities, including income tax, property tax, and other potential obligations, can affect net worth. Unpaid taxes represent a financial obligation and reduce the available resources. These are often unavoidable and regular components of an individual's financial responsibilities. Delays in tax payments can result in penalties that increase the overall debt, further reducing net worth. The amounts due and payment schedules are crucial in this context.

- Unsecured Debt

Unsecured debt, encompassing personal loans and outstanding bills, can impact net worth calculations. The amount of outstanding unsecured debt and its associated interest can decrease the overall financial value. The burden of these debts can impact an individual's ability to manage other financial aspects and potentially influence investment opportunities. The terms and conditions of these unsecured debts are essential.

The accurate assessment of liabilities is critical for a complete understanding of Patricia Azarcoya Schneider's financial position. Considering the interplay between various debt obligations and their impact on disposable income allows for a nuanced evaluation of her financial health and sustainability. The precise details of each liability type, including outstanding balances, interest rates, and repayment schedules, would provide a comprehensive perspective for a proper net worth assessment. Ultimately, liabilities serve as a critical counterpoint to assets, shaping the final valuation of net worth.

5. Professional Success

Professional success is a significant factor in determining an individual's net worth. A successful career often correlates with higher earning potential, leading to greater accumulation of wealth. The nature of an individual's profession, experience level, and market demand influence salary, bonuses, and opportunities for investment. Successfully navigating a demanding profession can lead to substantial capital accumulation over time.

A highly compensated individual in a high-demand field, such as finance or technology, will typically have greater earning potential. This elevated income allows for significant savings, investment opportunities, and the accumulation of assets such as real estate and other high-value holdings. Conversely, individuals in professions with lower earning potential may find it more challenging to accumulate substantial wealth, despite dedication and hard work. This disparity in earning potential demonstrates how professional success impacts the capacity to build and maintain financial resources. Moreover, professional achievements often translate into prestige and increased opportunities for profitable ventures. For instance, a successful entrepreneur's business acumen can generate substantial wealth through new ventures or expansion of existing enterprises, directly impacting net worth.

Understanding the link between professional success and net worth is crucial for individuals seeking to build wealth and secure their financial future. Recognizing the correlation allows individuals to strategize career paths that maximize earning potential and investment opportunities. This knowledge can assist individuals in aligning their career aspirations with financial goals. The impact of professional success extends beyond direct financial gain, influencing overall lifestyle, opportunity, and social standing. Ultimately, professional success often serves as a significant engine for economic growth and contributes substantially to an individual's net worth, presenting a complex interplay of skills, dedication, and market conditions.

6. Industry Trends

Industry trends significantly influence an individual's financial standing. The success or decline of a specific sector, market forces, technological advancements, and regulatory changes directly impact profitability, employment opportunities, and ultimately, accumulated wealth. Analyzing industry trends provides critical context for understanding factors that may affect an individual's economic position, like that of Patricia Azarcoya Schneider.

- Economic Downturns and Expansions

Recessions and economic booms drastically affect industries. During economic downturns, industries like consumer discretionary, real estate, and retail often experience reduced demand and lower profits. Conversely, growth sectors like technology and renewable energy see increased investment and expansion during expansions. This volatility impacts salaries, profitability, and investment opportunities directly affecting the wealth trajectory of individuals within those sectors.

- Technological Advancements

Technological advancements disrupt industries, creating new opportunities and rendering some obsolete. For example, the rise of e-commerce platforms fundamentally altered retail, impacting traditional brick-and-mortar stores and the profitability of those businesses. Individuals in industries affected by rapid technological change face the need to adapt their strategies and investments to remain relevant and profitable. This adaptability or lack thereof has a direct correlation with long-term financial security and therefore, net worth.

- Regulatory Changes

Government regulations significantly affect industries, impacting profitability and investment decisions. Stringent environmental regulations might impact companies operating in industries like energy and manufacturing, potentially reducing profit margins or forcing costly adjustments. These changes affect the financial performance of companies, impacting the compensation structure and potentially decreasing net worth for individuals connected to those industries.

- Competitive Landscape Shifts

Increased competition or consolidation in an industry can alter market dynamics and profitability. Entry of new competitors into established industries can lead to price wars, reduced market share, and potential job losses. This directly impacts individual financial security if they're employed or have investment interest in those affected sectors. A shift in competitive landscapes could diminish or increase the value of certain investments.

The interplay between these industry trends and an individual's economic standing, like that of Patricia Azarcoya Schneider, is multifaceted. Understanding industry-specific challenges, adaptation strategies, and market dynamics provides insight into the factors influencing their financial position. The success or failure of an industry can significantly influence an individual's financial opportunities and ultimately, the size of their net worth.

7. Public Information

Publicly available information plays a crucial role in understanding, albeit indirectly, an individual's net worth. Limited public data often hinders precise estimations. Information like employment history, professional affiliations, and publicly held assets can offer a degree of insight into financial standing. However, these insights are generally insufficient for a definitive calculation of net worth, which requires access to private financial records.

For instance, if Patricia Azarcoya Schneider is a publicly listed CEO, financial reports and shareholder information might reveal company performance and potential compensation. News articles, press releases, or regulatory filings may occasionally disclose significant transactions or holdings, providing indirect clues about financial decisions. However, direct disclosures of personal net worth are exceptionally rare, as such information is typically confidential and not mandated by public reporting requirements.

The availability of public information concerning Patricia Azarcoya Schneider's net worth is generally restricted. This limitation stems from privacy concerns and the confidential nature of financial affairs. Directly accessing private financial documents or estimations without permission is impossible and ethically inappropriate. This lack of readily accessible data makes precise valuations challenging and emphasizes the difference between public perception and accurate, private financial figures. Consequently, public information acts as a proxy or a limited indicator, highlighting the importance of distinguishing between publicly accessible and privately held financial details. While public information offers limited direct insight into net worth, it can be valuable for inferring general economic standing.

Frequently Asked Questions about Patricia Azarcoya Schneider's Net Worth

This section addresses common inquiries regarding the financial standing of Patricia Azarcoya Schneider. Accurate estimations of net worth require access to detailed financial information, which is often unavailable to the public. The following questions and answers offer insights into the complexities and limitations of such assessments.

Question 1: What is net worth, and how is it calculated?

Net worth represents the total value of assets owned by an individual, minus any debts or liabilities. Assets include various holdings like real estate, investments, and personal possessions. Liabilities encompass loans, mortgages, and outstanding financial obligations. Calculating net worth requires precisely valuing each asset and liability, a process that can be complex and challenging, especially for private individuals. The inherent difficulty in accessing comprehensive financial information prevents precise valuations.

Question 2: How accessible is information about Patricia Azarcoya Schneider's financial standing?

Publicly available information on individuals' financial situations is generally limited. Public records often contain only partial information. Precise valuations of net worth necessitate access to detailed financial statements, which are typically not publicly disclosed for individuals. Estimating net worth based solely on publicly available data can be imprecise and potentially inaccurate. Without direct access to private financial documents, precise valuations remain elusive.

Question 3: What role do industry trends play in evaluating net worth?

Industry trends significantly impact individual financial standing. Economic downturns, technological advancements, and regulatory shifts can influence an individual's financial success or setbacks. Individuals in fields subject to these changes experience corresponding fluctuations in their net worth. Understanding the industry context helps provide a more complete picture of an individual's financial trajectory.

Question 4: Can publicly available information provide insights into net worth?

Publicly available information, while limited, can offer indirect insights into an individual's financial standing. Professional affiliations, industry involvement, and company performance may give clues to overall financial success, but precise estimations are difficult to make without more specific information. Data such as investment performance is often not disclosed publicly.

Question 5: How important is investment history in assessing net worth?

An individual's investment history is a crucial factor in understanding their financial trajectory. Successful investments contribute to the accumulation of wealth, while poor investment choices can negatively impact net worth. Analyzing investment patterns reveals insights into financial decisions, risk tolerance, and potential future performance. However, comprehensive investment history is rarely publicly available. Investment history alone does not provide a definitive answer regarding net worth; other factors must also be considered.

Understanding the multifaceted nature of evaluating an individual's net worth requires careful consideration of multiple factors and an acceptance of inherent limitations. Limited access to complete financial information often leads to approximations rather than precise valuations.

This concludes the FAQ section. Further inquiries can be directed to specific sources regarding publicly available information related to Patricia Azarcoya Schneider. Additional information regarding net worth and financial analysis may be found in relevant financial publications or through consulting with financial professionals.

Conclusion

Determining Patricia Azarcoya Schneider's net worth proves challenging due to the inherent limitations of publicly available information. While professional success, industry trends, and publicly accessible details offer some clues, a precise valuation requires access to confidential financial records. The analysis highlights the complexities involved in assessing an individual's financial standing, emphasizing the distinction between public perception and private financial details. Key factors explored include asset valuation, income sources, investment history, liabilities, and the influence of industry trends. However, the lack of comprehensive, publicly accessible data necessitates acknowledging the limitations of estimations in this case. The article's exploration underscores the necessity of comprehensive data to accurately gauge net worth. Absent such data, definitive conclusions remain elusive.

This analysis underscores the crucial role of thorough financial documentation in clarifying an individual's economic position. Public interest in such matters necessitates the responsible handling of financial data and the ethical considerations surrounding privacy. Future inquiries may benefit from additional analysis of publicly available information, but the fundamental constraint of limited access to private financial records should be acknowledged. Understanding these limitations and the necessary context for accurate estimations is essential when interpreting financial standing.

You Might Also Like

Tiny Tormentor Insults For Short Friends!Jacelyn Reeves Photos & Pics - Stunning Images

Chanel Haynes Age: Everything You Need To Know

Trinity Morrissette: Artist & Influencer

Nina Dobrev Eyelids: Stunning Looks & Makeup Secrets

Article Recommendations

- Bill Emerson Bridge History Facts

- George Sakellaris Inspiring Stories Insights

- Best Led Qr Codes For Your Project Display